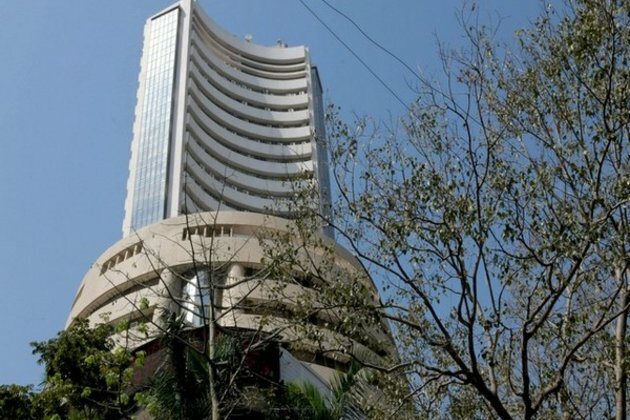

Sensex dips 525 points, Nifty slides below 18,000 mark

ANI

19 Jan 2022, 13:25 GMT+10

Mumbai [India], January 19 (ANI): The Indian equities markets were reeling under selling pressure for the second consecutive day on Wednesday with benchmark Sensex slumping 525 points and Nifty sliding below 18,000 points mark.

There was heavy selling pressure in IT, FMCG and banking and financial stocks. Infosys slumped by around two per cent. Wipro, HCL Technologies and TCS were down by close to one-and-a-half per cent.

The 30 stock SP BSE Sensex of the Bombay Stock Exchange was trading at 60,229.34 points are around 12.25 pm, which is 525.52 points or 0.86 per cent down from its previous day's close at 60,754.86 points.

The Sensex opened in the positive at 60,845.59 points and touched a high of 60,870.17 points. The index slipped to a low of 60,148.77 points.

The broader Nifty 50 of the National Stock Exchange was trading at 17,950.45 points, which is 0.90 per cent or 162.60 points down from its previous day's close at 18,113.05 points.

The Nifty touched a high of 18,129.20 points and low of 17,941.70 points.

Asian Paints slumped 2.77 per cent to Rs 3279.05. UltraTech Cement slumped 2.48 per cent to Rs 7378.95. The scrip fell sharply for the second consecutive day after announcing third quarter results. UltraTech Cement on Monday said its net profit rose by 8 per cent to Rs 1,708 crore for the third quarter of the current financial year as against Rs 1,584 crore recorded in the corresponding period of the last fiscal. The increase in profit is mainly because of a one-time gain of Rs 535 crore in tax for earlier years.

Bajaj Finance 2.40 per cent down at Rs 7561.50; Infosys 1.86 per cent down at Rs 1885.15; HCL Technologies 1.85 per cent down at Rs 1197.30; ICICI Bank 1.79 per cent down at Rs 808.65 and Hindustan Unilever 1.77 per cent down at Rs 2327 were among the major Sensex losers.

Only three of the 30 scrips that are part of the Sensex were trading in the positive. Nestle India was trading 0.17 per cent higher at Rs 19403.95. Maruti Suzuki 0.11 per cent higher at Rs 7924.35 and Tata Steel 0.12 per cent higher at Rs 1195.90 were the only Sensex gainers. (ANI) Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Santa Barbara Post news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Santa Barbara Post.

More InformationUnited States

SectionHome Depot sees sales rebound in Q4 after two-year slump

ATLANTA, Georgia: After two years of declining same-store sales, Home Depot finally saw a turnaround in the fourth quarter, fueled...

U.S. stocks rally despite Trump doubling-down on tariffs

NEW YORK, New York - U.S. stocks rallied on Friday as economic data showed the U.S. Federal Reserve has likely tamed inflation. The...

Personal Consumption Expenditures price index in January improves slightly

WASHINGTON, DC - The U.S. Federal Reserve seemingly has inflation under control with the latest econbomic data confirming little push...

Monkey business has global health authorities hopping

Ramadewa looked at the numerous troops of monkeys. They were at ease and happy and showed their liveliness. All their movements, their...

U.S. stock markets plummet as trade war heats up

NEW YORK, New York - U.S. stocks floundered on Thursday as new trade tariffs were imposed, and those paused were given the green light. ...

Unauthorized vapes surge: US sales hit $2.4 billion despite curbs

LONDON, U.K.: Despite regulatory efforts, unauthorized disposable vapes continue to dominate a significant portion of the U.S. e-cigarette...

International

SectionThree US female tourists found dead at Belize beach resort

MEXICO CITY, Mexico: Three American women were found dead over the weekend at a beach resort in Belize, police said. Officials are...

China launches live-fire drills after Vietnam's territorial claim

BANGKOK, Thailand: Chinese authorities said they started live-fire military exercises in the Gulf of Tonkin this week, just days after...

French warships join Philippines for South China Sea Drills

ABOARD THE CHARLES DE GAULLE, Philippines: France's nuclear-powered aircraft carrier and its warships arrived in the Philippines over...

Fresno State suspends two players, removes one amid gambling probe

FRESNO, California: Fresno State suspended two of its top men's basketball players last weekend and removed a third player from the...

Poland to continue covering Ukraine’s Starlink costs, says deputy PM

WARSAW, Poland: Deputy Prime Minister Krzysztof Gawkowski confirmed over the weekend that Poland has been covering the cost of Ukraine's...

Opinion - Israel's government exploited hostages

Israel sustained the West's support for its slaughter in Gaza for 15 months only through an intensive campaign of lies. It invented...